In an effort to build a more sustainable future, businesses are utilizing more renewable energy sources to power their operations. Geothermal energy has distinguished itself as a dependable and environmentally beneficial option among the range of options. Governments are providing enticing incentives like the commercial geothermal tax credit to further entice enterprises to embrace geothermal technology. This tax credit promotes environmental sustainability while lowering costs for enterprises. In this article, we’ll examine the benefits of the commercial geothermal tax credit and how it might motivate companies to implement environmentally friendly procedures.

Understanding the Commercial Geothermal Tax Credit

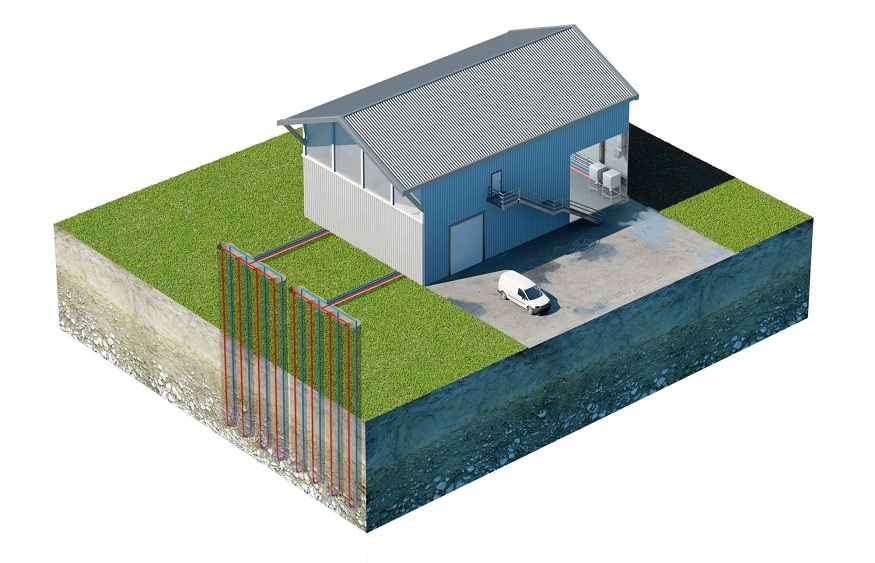

Businesses are encouraged to construct geothermal heating and cooling systems thanks to the government’s commercial geothermal tax credit program. The cost of installing geothermal systems can be partially offset by qualifying firms using this credit, reducing their tax obligations. The main goals of this incentive are to promote the use of renewable energy, reduce greenhouse gas emissions, and ultimately support efforts to address climate change on a global scale.

Key Benefits for Businesses

- Financial Incentives: One of the key advantages of the commercial geothermal tax credit is the financial support it offers to enterprises. Due to the credit, the upfront costs of building geothermal systems have greatly lowered, making switching to renewable energy more feasible for companies of all sizes.

- Long-Term Savings: For their incredibly high energy efficiency and little maintenance needs, geothermal systems are well known. Instead of largely relying on external energy sources, these systems deliver dependable heating and cooling using the Earth’s inherent heat. Businesses might experience a significant reduction in energy expenses over time, which will help them keep their financial situations constant.

- Environmental Responsibility: Geothermal energy use is consistent with a business’ commitment to environmental responsibility. Businesses may significantly reduce their carbon footprint and enhance the quality of the air and water by using fewer fossil fuels.

- Enhanced Reputation: As consumers grow increasingly concerned about the environment, businesses that demonstrate a commitment to sustainability are more likely to receive their support. Geothermal technology adoption can improve a business’s reputation and draw environmentally conscious customers, which will boost customer retention.

- Reduced Vulnerability to Energy Price Volatility: The price of traditional energy sources may vary depending on geopolitical and market factors. However, geothermal energy is a reliable and consistent source that can protect companies from the risks brought on by unstable energy prices.

Eligibility and Application Process

For businesses to be eligible for the commercial geothermal tax credit, specific criteria set by their respective governments must be met. Qualification requirements usually include the installation of approved geothermal systems as well as adherence to predetermined efficiency and environmental standards. Typically, as part of the application procedure, evidence of system installation, energy use, and costs is required.

Conclusion

Companies now have a unique opportunity to implement environmentally friendly practices while benefiting significantly financially thanks to the commercial geothermal tax credit. By exploiting this incentive, businesses can drastically lower their carbon footprint and contribute to the development of a cleaner, more robust environment. The commercial geothermal tax credit offers a ray of hope for a future that is more ecologically conscious as firms and governments collaborate to promote renewable energy sources. By implementing this program, you show that you are dedicated to promoting both fiscal responsibility and a sustainable, healthy planet for future generations.